Beginning on January 1, 2024, many legal entities in the United States now have to report to the federal government information about their beneficial owners—i.e., the individuals who ultimately own or control the company through the Corporate Transparency Act. The information will be stored in a secure nonpublic federal government database. Here are the key takeaways for you and your business.

What is the Corporate Transparency Act (CTA)?

– The CTA is a new reporting requirement that allows the Financial Crime Enforcement Network (FinCEN) to collect information about Reporting Companies, Beneficial Owners, and Company Applicant(s).

– The CTA’s primary purpose is to assist FinCEN with pursuing financial crimes.

– The CTA went into effect on January 1, 2024, concurrent with the launch of FinCEN’s BOI E-Filing portal where Reporting Companies can file Beneficial Ownership Information reports electronically.

– Reporting Companies created or registered prior to January 1, 2024, must complete an initial report with FinCEN before January 1, 2025.

– Reporting Companies created or registered on or after January 1, 2024, but before January 1, 2025, must complete an initial report within 90 days, and Reporting Companies created or registered on or after January 1, 2025, must complete an initial report within 30 days.

– Inaccurate reports, whether by error or by a change in underlying information that requires updating, must be filed within 30 days of the change or the discovery of the inaccuracy.

– The reporting requirement for Company Applicant(s) Information only applies to companies created on or after January 1, 2024. Entities created prior to January 1, 2024, are only responsible for reporting information from the following categories: (1) Reporting Company Information and (2) Beneficial Ownership Information.

Who does it impact?

– Under the CTA, only those companies deemed Reporting Companies are required to report information to FinCEN.

– Reporting Companies fall into one of two categories: (1) domestic Reporting Companies and (2) foreign Reporting Companies.

– Domestic Reporting Companies are any corporation, limited liability company, or other similar entity that is created by the filing of a document with a secretary of state or a similar office of a U.S. state (including any commonwealth, territory, or possession of the United States) or Indian tribe, unless exempt under the CTA.

– Foreign Reporting Companies are any corporation, limited liability company, or other similar entity formed under the law of a foreign country and registered to do business in any U.S. state or tribal jurisdiction by the filing of a document with a secretary of state or a similar office of a U.S. state or tribe, unless exempt under the CTA.

What are the exemptions?

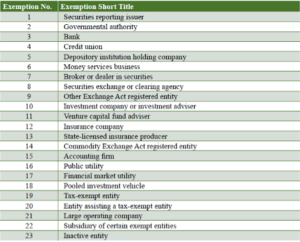

The CTA currently recognizes 23 exemptions to the reporting requirement:

What information must be reported?

The CTA requires that Reporting Companies report the following three categories of information:

(1) Reporting Company Information

Either (A) FinCEN Identifier, or (B) an Identifier which requires (i) full legal name used to establish the entity; (ii) any trade names or “doing business as” name, whether registered or not; (iii) address (for a domestic Reporting Company, the street address of the principal place of business, and for a foreign reporting company, the primary location in the United States where the Reporting Company conducts business); (iv) jurisdiction of formation (for a foreign Reporting Company, the state or tribal jurisdiction where the company first registers); and (v) IRS taxpayer identification number (TIN) or, if a TIN has not yet been issued for a foreign Reporting Company, a tax identification number issued by a foreign jurisdiction and the name of such jurisdiction.

(2) Beneficial Ownership Information

Either (A) FinCEN Identifier, or (B) an Identifier which requires (i) full legal name; (ii) date of birth; (iii) current residential street address; (iv) identification number (e.g., a unique identifying number and the issuing jurisdiction of a non-expired U.S. passport, non-expired driver’s license, or other non-expired identification document issued by a state, local, or tribal jurisdiction, or, if none of those is available, then a non-expired passport issued by a foreign jurisdiction); and (v) image of identification document. Beneficial Ownership Information must be provided for any individual who, directly or indirectly: (A) exercises substantial control over the Reporting Company, or (B) owns or controls 25 percent or more of the ownership interests of the Reporting Company.

– Substantial control: An individual exercises substantial control over a reporting company if the individual serves as a senior officer; has authority over the appointment or removal of any senior officer or a majority of the board of directors (or similar body); directs, determines, or has substantial influence over important decisions; or, has any other form of substantial control.

– Owns or controls 25 percent or more of the ownership interests: Ownership interests include equity, stock, voting rights, a capital or profit interest, convertible instruments, options, other non-binding privileges to buy or sell any of the foregoing, and any other instrument, contract, or mechanism used to establish ownership.

(3) Company Applicant(s) Information

For the person who directly files the formation or registration document of the Reporting Company and the person who was primarily responsible for directing or controlling the filing, either (A) FinCEN Identifier, or (B) which requires (i) full legal name; (ii) date of birth; (iii) current business/residential street address; (iv) identification number (e.g., a unique identifying number and the issuing jurisdiction of a non-expired U.S. passport, non-expired driver’s license, or other non-expired identification document issued by a state, local, or tribal jurisdiction, or, if none of those is available, then a non-expired passport issued by a foreign jurisdiction); and (v) image of identification document.

Penalties for Noncompliance:

Those who willfully fail to report, fail to update reports, willfully submit or attempt to provide false or fraudulent reports, cause the failure to file a required report, or were a senior officer at the time of the failure to file may face civil and/or criminal penalties.

– Civil fines of $500 per day will be assessed for each day a violation continues.

– Criminal penalties include imprisonment for up to two years and/or fines of up to $10,000 per violation.

Disclaimer. The contents of this article should not be construed as legal advice or a legal opinion on any specific facts or circumstances. The contents are intended for general informational purposes only, and you are urged to consult with counsel concerning your situation and specific legal questions you may have.